Have you ever noticed an extra charge on your bill labeled as GST? That’s the Goods and Services Tax – a tax that affects almost everything we buy or sell. Whether you’re a consumer paying for groceries, or a business owner selling products online, GST plays a big role in pricing, accounting, and budgeting.

In this guide, we’ll walk you through:

- What GST is

- How it works globally

- The impact on individuals

- The impact on businesses

- How it differs by country

Let’s break it down in a way that makes sense, no accounting degree needed.

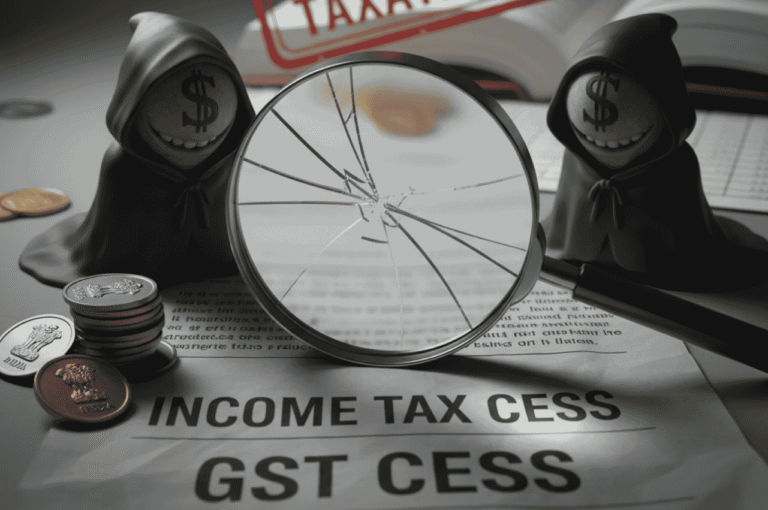

1. What is GST?

Goods and Services Tax (GST) is a consumption-based indirect tax. It’s added to the price of goods and services and paid by the final consumer. Businesses collect GST on behalf of the government and pass it along through their supply chains.

Think of it this way:

You buy a T-shirt. The store charges you a little extra as GST. They send that amount to the government. That’s it—you’ve paid GST.

2. How GST Works Around the World

Let’s look at how GST or similar taxes work in different countries:

India

- GST was introduced in 2017 to replace multiple indirect taxes.

- It’s a multi-rate system: 5%, 12%, 18%, and 28% depending on the item.

- Basic needs (like milk) may be taxed at 0%, while luxury items are taxed higher.

- Both businesses and service providers must register for GST if turnover exceeds a certain limit.

Impact on Individuals: GST is added to most purchases.

Impact on Businesses: Must collect, report, and file GST regularly. Can claim input credit on purchases.

Australia

- Known as GST, introduced in 2000.

- Flat rate of 10% on most goods and services.

- Businesses with over $75,000 AUD annual turnover must register.

- Includes GST in listed prices (no surprises at checkout).

Impact on Individuals: GST is included in prices, so it’s more seamless.

Impact on Businesses: Businesses collect and remit GST and can claim GST credits on business expenses.

Canada

- Called GST, combined with HST (Harmonized Sales Tax) in some provinces.

- Federal GST is 5%, HST varies by province (up to 15%).

- Businesses must register if annual sales exceed $30,000 CAD.

Impact on Individuals: GST is added at checkout in most provinces.

Impact on Businesses: Must charge GST/HST and file returns. Eligible for Input Tax Credits.

United Kingdom or Great Britain

- Similar system called VAT (Value-Added Tax).

- Standard VAT rate is 20%, with reduced rates (5%) and zero-rated items.

- Businesses must register if turnover exceeds £90,000 (as of 2025).

Impact on Individuals: VAT is already included in most prices.

Impact on Businesses: Must collect VAT and file VAT returns quarterly. Can reclaim VAT on expenses.

United States

- No national GST or VAT.

- Instead, states charge Sales Tax, usually between 4% to 10%.

- Collected at the point of sale, and rules vary by state.

Impact on Individuals: Sales tax is added at checkout and differs by location.

Impact on Businesses: Businesses must register in each state they operate and collect appropriate tax.

3. GST for Individuals:

What You Need to Know – Even though individuals don’t file GST returns, you’re affected every day:

Where You See It:

- Grocery bills

- Restaurant checks

- Online shopping

- Utility bills

- Professional services

What It Means:

- The more you consume, the more GST you pay.

- Some essential goods may be tax-free or taxed at a lower rate.

- Businesses include GST in their pricing, so you’re often paying it without realizing.

Tip for Consumers: Always check your bill to ensure you’re not overcharged. In some countries, you can even claim GST refunds (e.g., tourists in Australia or EU countries).

4. GST for Businesses:

Key Responsibilities – Running a business? Here’s what you need to do:

1. GST Registration

- Required once your revenue crosses a certain threshold (varies by country).

- You receive a GSTIN or business number.

2. Charge GST

- Add GST to your invoices and collect it from customers.

3. Claim Input Tax Credit (ITC)

- You can deduct the GST you paid on business-related purchases from the GST you collected.

4. File GST Returns

- Monthly, quarterly, or annually based on your country’s laws.

Tip for Businesses: Use accounting software to automate GST tracking and ensure compliance.

5. GST vs VAT: What’s the Difference?

Both Goods and Services Tax (GST) and Value Added Tax (VAT) are consumption taxes, but here’s how they differ:

| Feature | GST | VAT |

|---|---|---|

| Name Usage | Common in India, Australia, Canada | Common in UK, EU, and some other countries |

| Tax Structure | Multi-stage, collected at each step | Similar structure |

| Credits | Input tax credit system | Input VAT can be reclaimed |

| Transparency | Often more streamlined | Depends on country laws |

In practice, they work almost the same for both consumers and businesses.

Why GST Matters for Money Management

Whether you’re shopping for groceries or running a startup, GST impacts your financial life. Here’s why it’s important:

- Helps you understand the true cost of goods and services.

- Encourages transparent pricing.

- As a business, you can manage cash flow better with input credits.

- Knowing your GST obligations helps you stay compliant and avoid penalties.

Takeaways

- GST is a tax on consumption, paid by individuals and collected by businesses.

- It varies by country in name, rate, and structure.

- For businesses, proper GST management is key to financial health.

- For individuals, understanding GST helps with smart spending.

Want More Practical Money Tips?

Subscribe to our money management blog for easy guides on taxes, savings, and smarter money habits for everyday life and business success.